Decentralized Crypto Exchange Platform

Содержание

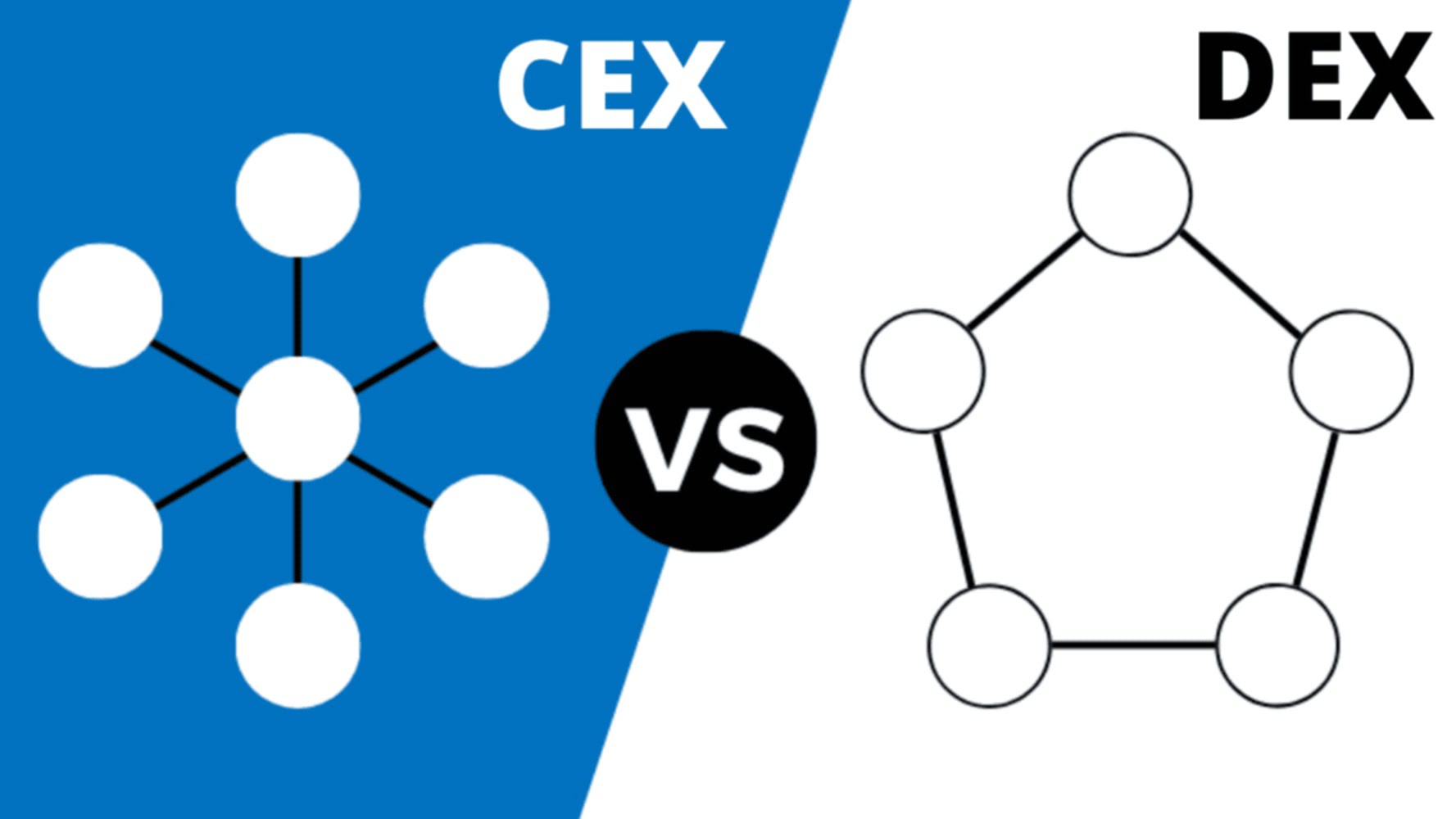

A decentralized exchange is an online peer-to-peer cryptocurrency exchange service which operates without central authority responsible for the asset storage and swapping. This service allows quick and easy cryptocurrency transactions between two interested parties without unnecessary movement of crypto funds with attached fees and complete anonymity. We all remember too well the wave decentralized bitcoin exchange of crypto exchange hacks that shook the Blockchain community and showed that safekeeping of any assets, crypto included, is a responsible and challenging task. One too many exchanges went down due to an external or internal hack, with attackers making it off with a significant portion of exchange funds. Balancer is a non-custodial automated portfolio manager and trading platform.

One major problem with illiquid assets on regular exchanges is “high spreads.” Uniswap solves this problem by enabling everyone to become a market maker. Uniswap suffers from high slippage for large orders because the price paid increases with the increase in the quantity. https://xcritical.com/ Decentralised exchanges or DEXs enable users to buy and sell cryptocurrencies with one another without the need for brokers. Users connect their crypto wallet to a DEX, select their crypto trading pair of choice, enter the amount, and hit the swap button.

Curve, Uniswap, Pancakeswap, Sushiswap, Balancer Have Been Listed As The Top Five Decentralised Exchanges

PancakeSwap is an automated market maker and yield farm on the Binance Smart Chain . Although PancakeSwap is a fork of SushiSwap, it enables cheaper and faster transactions because it runs on BSC. Uniswap is a decentralised protocol for automated liquidity provision on Ethereum.

The fees and other parameters are decided by the Curve Decentralised Autonomous Organization . Half of the fee goes to the liquidity providers and the other half to the members of the DAO. Watch the market charts to monitor prices and market activity for other market pairs, powered by TradingView, or any other trading chart API. Buy and sell bitcoin for fiat privately and securely using Bisq’s peer-to-peer network and open-source desktop software.

Decentralized Crypto Exchange Platform

NDTV shall not be responsible for any loss arising from any investment based on any perceived recommendation, forecast or any other information contained in the article. Issue and manage new tokens to digitalize assets – create, mint/burn, and freeze/unfreeze. Open-Source Decentralized Crypto Exchange is an inventive solution to deploy a cost-effective Uniswap-based cloud software-as-a-service in record time. Deposits held in 2-of-2 multisig wallets encourage safe, successful trades. No need to wait for approval from a central authority.

Rohas Nagpal is the author of the Future Money Playbook and Chief Blockchain Architect at the Wrapped Asset Project. Slippage is the difference between the expected price of a trade and the price at which the trade is executed. Run a full node to listen and broadcast chain transactions, blocks, and consensus. Your data is stored locally on-disk, and is never sent to a central server. Every Bisq node is a Tor hidden service by default.

Deep Dive Into Decentralised Finance: Top 5 Decentralised Exchanges, Or Dex

It also enables yield instruments and staking derivatives. In late 2020, Yearn.finance and SushiSwap announced a merger under which they would share development resources, but maintain separate tokens and governance systems. Talk to technical sales for more platform architecture details and a free decentralized cryptocurrency exchange demo. The stream of centralized exchange platforms introduced both major crypto awareness as well as significant security challenges.

In a conventional index fund, the investor pays fees to a portfolio manager for rebalancing the portfolio. In Balancer, the investor collects fees from traders who rebalance their portfolio by following arbitrage opportunities. SushiSwap is a decentralised protocol for providing automated liquidity on Ethereum. It is a decentralised exchange and a decentralised lending market.

Join The Community

Curve, Uniswap, PancakeSwap, SushiSwap, Balancer have been listed as the top five decentralised exchanges. Send orders to buy and sell crypto assets through created trading pairs. Decentralized governance for a decentralized exchange, built on top of Bitcoin. Cryptocurrency is an unregulated digital currency, not a legal tender and subject to market risks. The information provided in the article is not intended to be and does not constitute financial advice, trading advice or any other advice or recommendation of any sort offered or endorsed by NDTV.

- A decentralized exchange is an online peer-to-peer cryptocurrency exchange service which operates without central authority responsible for the asset storage and swapping.

- Users connect their crypto wallet to a DEX, select their crypto trading pair of choice, enter the amount, and hit the swap button.

- This service allows quick and easy cryptocurrency transactions between two interested parties without unnecessary movement of crypto funds with attached fees and complete anonymity.

- Uniswap suffers from high slippage for large orders because the price paid increases with the increase in the quantity.

- The information provided in the article is not intended to be and does not constitute financial advice, trading advice or any other advice or recommendation of any sort offered or endorsed by NDTV.

- Run a full node to listen and broadcast chain transactions, blocks, and consensus.